Family Offices and the “hybrid” options open to your Family

When we meet with clients the first time, especially those who have never engaged a financial adviser before, they sometimes struggle with the family office concept. This is not a common service offering in Australia, and generally is in the domain of firms that have a true “strategic financial adviser” focus. To further complicate the manner, hybrid family offices are now offering a varied level of internal and external support. How do you pick the right one?

When speaking to our clients, a common outcome they are all seeking is some direction, purpose and surprisingly just simplicity around their already complex lives. This is not saying they want to stop doing what they do well and take a step back. It is quite the contrary. They want to embrace more challenges, better the lives for their family, do new things that they have been holding back on… but know they can’t necessarily do this objectively with all the noise going on in their lives – sound familiar?

I recently read a book by Andrew May and he talks about the concept of being “match fit”. Besides the message of fitness to maintain our body and brain fitness, he talks about some steps to prepare your life, and that the thought of squeezing more into an already jam-packed schedule can be overwhelming. Andrew comments that the key to this is to create capacity to free up time, energy and attention…something that we find a common theme amongst people we meet and help.

So how does this all relate to your choice of a family office?

Are hybrid family office structure’s suited to me?

The genesis of the traditional family office came from the US where some of the wealthiest families were dis-satisfied with the limited scope of the banks, unable to look after the total financial needs of their families. They bought in the resources they needed to work solely for the family. Over time and in Australia they have morphed into a myriad of hybrids that have varied resources internal and external to deliver the services and advice they need.

Our view is that a client should be surrounded by the best possible people to advise them. Having the best possible tax accountant, lawyer, estate planner and so on, all under the one roof for every client is near impossible, so the hybrid model in our opinion works well.

The need for a collaborative approach

With differing perspectives come different opinions and so we find very rarely is there only one solution to a problem as there may be several viable solutions, all with varying financial benefits.

It is important to remember that the best financial result may not be the best long-term solution and collaboration across family members and advisers will get the best-suited outcome.

Keeping the framework simple

The use of a hybrid family office model that is unique and specific to the family, provides the framework to make our complex lives simpler. We find that tools such as advice maps, financial modelling and family meetings keep everyone on the same page and working in the right direction.

Understanding the difference between family and business governance

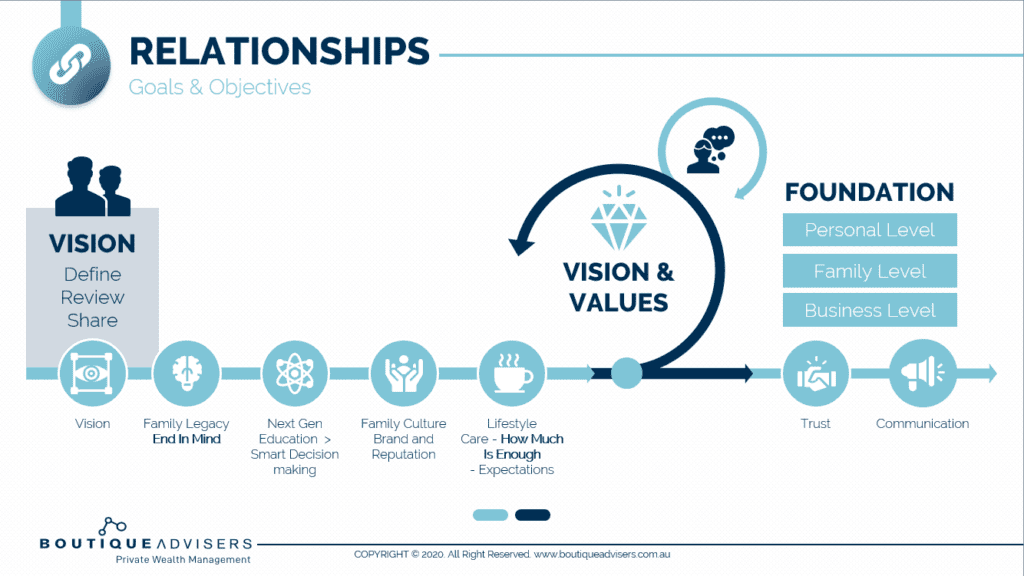

This is commonly termed the zone of confusion and family owned and operated businesses often fall foul of this. Being consciously aware that there are differences between personal, family and business objectives and understanding the commonality that binds them.

Generally, we believe that there is a benefit to a family to formally sit down on an agreed periodic basis with an agenda to discuss the family and business governance. This allows them to keep everyone on the right path.

Don’t jump the gun – start at the foundation stage.

There is no short cut in doing this properly and starting at the beginning to lay the foundations is important. At the basis of any Family Office is the collective need for trust and communication between all parties. We find that families sometimes go into solution mode too early without really understanding the core of the issues, needs and problems faced by all parties.

Spending the time to lay the strong foundations, in our experience, is time well spent to sustain a happy family and a strong generational business.

At Boutique we believe that a hybrid family office solution can provide families the comfort of all working together in the right direction. Using a hybrid structure reduces the risk and cost to the family of setting it up themselves and has the unique ability to change and grow as the family needs change.

Gary Hasler is the Managing Director of Boutique Advisers and works with highly successful individuals and families, providing strategic financial advice. Gary specialises in working with generational family businesses, executives and family office clients as well as high level professional athletes. Gary is passionate about working with Boutique clients in a collaborative way, providing clarity and confidence, and helping them navigate their best financial life.