With higher levels of uncertainty in financial markets due to a myriad of global issues (COVID, the Ukraine war, supply chain interruptions), many have postponed investing with the worry of losing their hard-earned cash. But the current high inflationary environment (5.1% in Australia for the first quarter of 2022) means that those sitting on the sidelines are effectively losing money by parking cash in their bank accounts. This is especially evident in younger generations who haven’t invested before and aren’t accustomed to how investment markets decline and recover over time.

There are always risks when investing, however starting out on your investment journey sooner rather than later can make a big difference over the long term. With that in mind, below is a guide to starting out on this journey and why you should put an investment plan in place now rather than later.

Work out how much you can save to invest

As first steps, you should know how much you can afford to invest on an ongoing basis. The difference between your income after tax and what you spend, is effectively your entry point into investing:

- Work out your income after tax monthly.

- Record where your money goes for a month and categorise each item into either essential or luxury. Don’t forget to include essential costs which you usually pay yearly such as car and home insurance and apportion those funds into a monthly amount (divide by 12 in this case).

- Offset your total costs against your planned monthly income. If this amount is small or there is a shortfall between your income and costs, are there any luxury items you could forego?

We suggest investing early and as much as you can afford on a regular basis.

Invest for the long term

Market downturns happen frequently but don’t last forever and are an unavoidable part of investing. Higher risk generally provides for greater returns however this mantra is more likely to ring true over a longer timeframe. Investors who don’t have this in mind are often left exposed when they want to access their investment and find that the timing isn’t right as markets have recently dropped off.

The table below indicates just how frequently markets (500 of America’s largest companies in this case) can decline and the average recovery time applicable to market drops of differing sizes:

As a rule of thumb when investing in share or property markets, it is important that you commit to invest for a minimum timeframe of at least 7 years. You may have a different experience and find that your investments have risen over the short term but it’s always best to temper your expectations and plan for future market declines. Often, time invested in the market is more important than market timing, with even the most experienced of investors struggling to get exact timing of investing right.

If you know that you will need funds sooner than this, consider using a high interest savings account for the portion you want to access in the short term.

What investments and risk level is appropriate?

There are numerous options available to you in the modern-day investment universe in addition to your traditional investment into companies listed on the Australian Stock Exchange. With the rise of alternatives investments such as Cryptocurrency and NFT’s (Non-fungible tokens) in addition to the sheer number of fund managers out there, it can seem overwhelming when choosing where to invest.

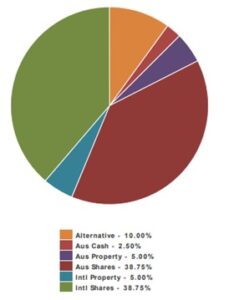

No matter which investments you choose, there is one very important rule to apply to your overall investment plan – Diversification is key. The graph below illustrates a well-diversified approach to a growth-oriented investment portfolio:

You should look for investments, or a mix of investments which meet the above criteria. Adequate diversification helps to reduce investment risk by splitting your pool of funds across different investment types, industries and styles of management. This is because different areas will each react differently to the same event, be it a pandemic, war, or other global event.

The power of compounding returns

Albert Einstein, although known as a genius but not necessarily an investor, famously hit the nail on the head when he said “Compound return is the 8th wonder of the world. He who understands it, earns it. He who doesn’t, pays it”.

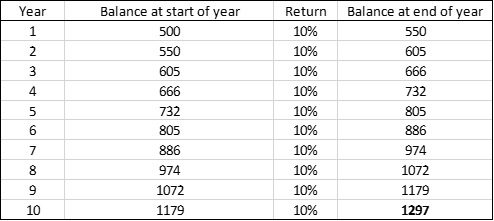

By harnessing the power of compounding returns you’re effectively earning a return on top of your return. To give you an idea of how this works, let’s assume that you invest $500 and earn a 10% return on this amount each year for ten years. The return you make is then reinvested into purchasing additional units in your investment:

$500 is a modest investment amount, but due to this ‘snowballing’ effect, that’s close to a 160% return over 10 years! This is important because starting off on your investment journey now and harnessing the power of compounding can help achieve your longer-term goals and aspirations.

Seek Advice

Sorting through the above can be daunting for some, especially if you are new to investing. Consult a professional who can guide you through this process and alleviate you of this responsibility, this will enable you to make clear and confident decisions when it comes to establishing a long-term investment plan.

Not to mention home ownership, superannuation and protecting your accumulated wealth are equally as important areas to include in your overall investment planning, which a financial adviser will be able to guide you through. This is just one step of your financial life journey, so it can pay to establish a long-standing relationship with someone you can trust throughout your lives.

Sean Hocking works with professionals and their families to provide peace of mind and clarity around their financial future. Having a roadmap in place which clearly articulates what’s important in the years to follow gives his clients the confidence to make clear and informed decisions throughout their financial life journey.