There has been a huge reaction to Government’s proposed changes to the Stage 3 tax cuts which are scheduled to take effect from July 2024. This is likely to remain an emotive topic for the next few months.

If legislation is passed by Parliament and the proposed changes come into law, the revised Stage 3 tax cuts will:

- reduce the 19% tax rate to 16%,

- retain the 37% tax bracket which was due to fall away from July 2024, but increase the band to which this applies from $120,000 to $135,000, and

- Lower the 45% tax threshold from $200,000 to $190,000.

It is also proposed that the Medicare levy low-income threshold will be increased, thereby removing the Medicare levy from more Australians.

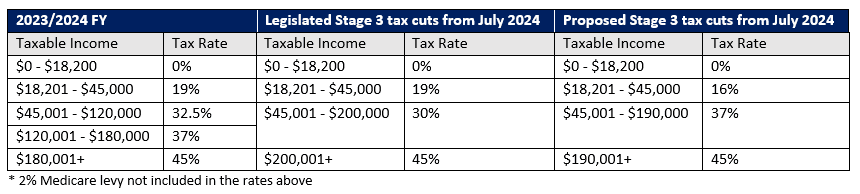

Comparison between the current legislated and proposed thresholds

The table below compares the current legislated Stage 3 tax cuts with the proposed rates and thresholds.

Impact on tax savings

So, what is the financial impact likely to be? Whilst all taxpayers will see a reduction in their current tax bill under both the legislated and proposed Stage 3 tax cuts, those earning less than around $140,000 pa will benefit from higher tax savings if the proposed changes are passed into law. This translates to a benefit for about two thirds of all taxpayers.

For someone earning $100,000 pa, their tax reduction under the proposed tax cuts will increase from $1,375 to $2,179. However, for someone earning $200,000 pa, their expected tax saving would be halved from $9,075 to $4,529.

Further thoughts

Government’s intention to tax higher income earners was evidenced last year when tax on super earnings for balances over $3 million was doubled from 15% to 30% effective July 2025. This change alone is expected to generate an additional $2 billion in tax over 4 years from half a per cent of the population.

The proposed new Stage 3 tax cuts again seeks to lean on a single group of tax payers to do the heavy lifting.

The proposed tax cuts will likely put upward pressure on inflation which in turn may result in upward pressure on interest rates and we could see current official rate of 4.35% in place for longer.

On a positive note, tax cuts which benefit the lower and middle income earners will improve their ability to service mortgages. This may cushion the risk of ‘distressed selling activity’ identified by SQM Research when it forecast a possible drop in values of properties in the eastern states during 2024.

The way forward

Investors should understand in dollar terms what the revised tax cuts will mean for them if the changes are passed into law. It will be prudent to meet with their financial planners to revisit their existing arrangements which likely relied upon the already legislated tax cuts. Particular advice which may be impacted relates to decisions around the timing of personal deductible contributions to maximise tax benefits, contributions relying on additional cashflow from the Stage 3 tax cuts and the disposal of assets and realisation of capital gains/ losses.

For any questions as to how these proposed tax cuts may impact you, contact one our Private Wealth Advisers to discuss.

Karen Haarhoff is passionate about building long-term relationships with clients and working alongside them to achieve their financial and lifestyle goals. She enjoys helping clients make informed, confident decisions about their financial affairs and providing both clarity and structure around their financial affairs.